China's new Price Settlement Mechanism on Renewable Energy: Implications for the Green Power and Green Electricity (GEC) Markets

- 17 minutes ago

- 3 min read

In February 2025, China's National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) jointly released Document No. 136, introducing the price settlement mechanism for the sustainable development of renewable energy. The policy aims to advance the full market participation of renewable electricity while ensuring revenue stability for renewable energy projects during the transition.

This mechanism functions as an off-market price adjustment framework. When the market electricity price falls below the electricity price level for renewable energy covered by the mechanism (referred as “mechanism-based electricity pricing”), the grid company compensates the renewable generator for the difference; when market prices exceed the mechanism-based price, the excess revenue is returned. This approach enables renewable electricity to fully enter the power market while providing a revenue safeguard, forming a complementary institutional pillar alongside green power trading and the green electricity certificate (GEC) system.

Policy implementation distinguishes between existing and new projects. Existing projects commissioned before 1 June 2025 generally benefit from higher proportions of electricity eligible for the mechanism, with some provinces extending coverage to nearly all generation. New projects commissioned after 1 June 2025 are generally required to participate in competitive bidding, with capped settlement volumes and defined support periods that vary by province.

From an international standpoint, feed-in premium (FIP) schemes such as Japan’s share a core objective with China’s price settlement mechanism: integrating renewable energy projects into competitive electricity markets while providing revenue support linked to market outcomes. In both systems, eligibility is typically determined through competitive bidding. While Japan’s FIP applies bidding requirements selectively based on technology type and project size, and China’s mechanism generally requires bidding for all new projects, the underlying intent in both systems is to balance revenue stability with market integration as renewable capacity scales and market structures mature.

Implications for GEC Supply and Demand

Document No. 136 clearly stipulates that electricity volumes settled under the mechanism-based electricity pricing are not eligible for additional GEC revenues.

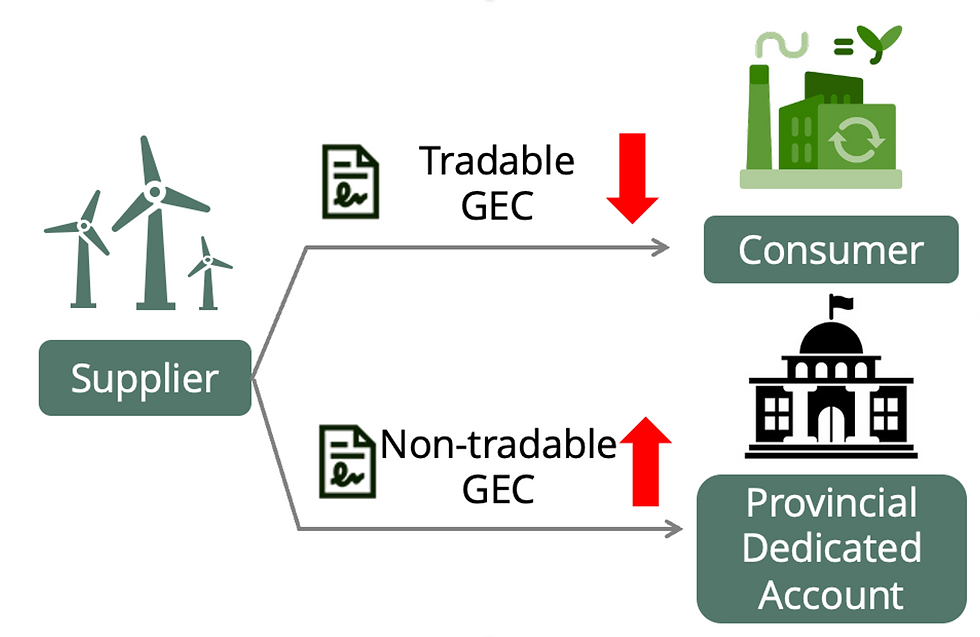

At the provincial level, implementation approaches vary. Some jurisdictions, such as Beijing, have clarified that GECs associated with mechanism-based electricity volume are transferred to provincial or municipal accounts and allocated collectively to end users for consumption recognition, rather than entering the market for independent trading. In other regions, detailed rules for handling these certificates have not yet been fully clarified.

From a supply–demand perspective, this design has material implications for the GEC market. As a significant share of renewable electricity is settled under the mechanism-based electricity pricing, the corresponding GECs are effectively absorbed into the mechanism framework and do not circulate in the open market. This reduces the volume of GECs available for market-based transactions (Figure 1).

At the same time, demand for GEC continues to expand, driven by corporate decarbonization commitments, international initiatives such as RE100, and increasing supply chain disclosure requirements. Against this backdrop, a tightening of tradable GEC supply may emerge, and if a large proportion of renewable generation remains within the mechanism-based electricity pricing system, the resulting imbalance between stronger demand and reduced available supply may exert upward pressure on tradable GEC prices in 2026 from a market fundamentals perspective.

Considerations for Corporate Buyers

For corporate buyers in China, the introduction of the mechanism-based electricity pricing adds an important dimension to the procurement strategies of renewable energy. Beyond electricity prices, companies will need to assess how much renewable supply in a given province is covered by the mechanism-based electricity pricing and the availability and cost of unbundled GECs in the market.

Understanding these dynamics will be increasingly important for corporates seeking to manage procurement costs, secure sufficient GEC supply, and ensure the robustness of renewable electricity usage claims. As provincial implementation rules continue to evolve, close attention to local policy details and market signals will remain critical.

At Mt. Stonegate, we help companies navigate evolving power markets and design resilient, compliant renewable procurement strategies for sustainable growth. Let’s work together to turn decarbonization targets into real projects and measurable impact!

Comments